does shopify provide tax documents

You then collect the taxes and remit them based on the schedule the state assigns you. Lucky you Shopify does provide some tools that can make your Shopify tax preparation a bit easier.

Finding And Filing Your Shopify 1099 K Made Easy

The calculations and reports that Shopify provides should help make things easier when its time to file and pay your taxes.

. As you set up taxes you can access and review your settings on the Taxes page in your Shopify admin. How To Track Sales Tax. Please note that if a 1099 is issued it is very important that the number reported on your tax return matches the number on your 1099.

In the Sales tax ID enter your sales tax ID. Customer creates account and contacts your rep who gets their information. Welcome to the Shopify Community and congratulations on your launch.

You want to avoid any mistakes that could involve leaving money on the table or result in costly penalties. You might need to register your business with your local or federal tax authority to handle your sales tax. Theyre also your first line of defense in case of an audit.

Shopify offers automatic tax settings to help you set up default sales tax rates. However the tools on Shopifys platform will make it easier for you when its time to file your taxes. Shopify surely helps you collect sales tax on your orders but it does not automatically report them to the authorities on your behalf.

Shopify doesnt file or remit your sales taxes for you. Sorry to hear youve been having issues collecting taxes. You simply need to select the beginning and end date of your report.

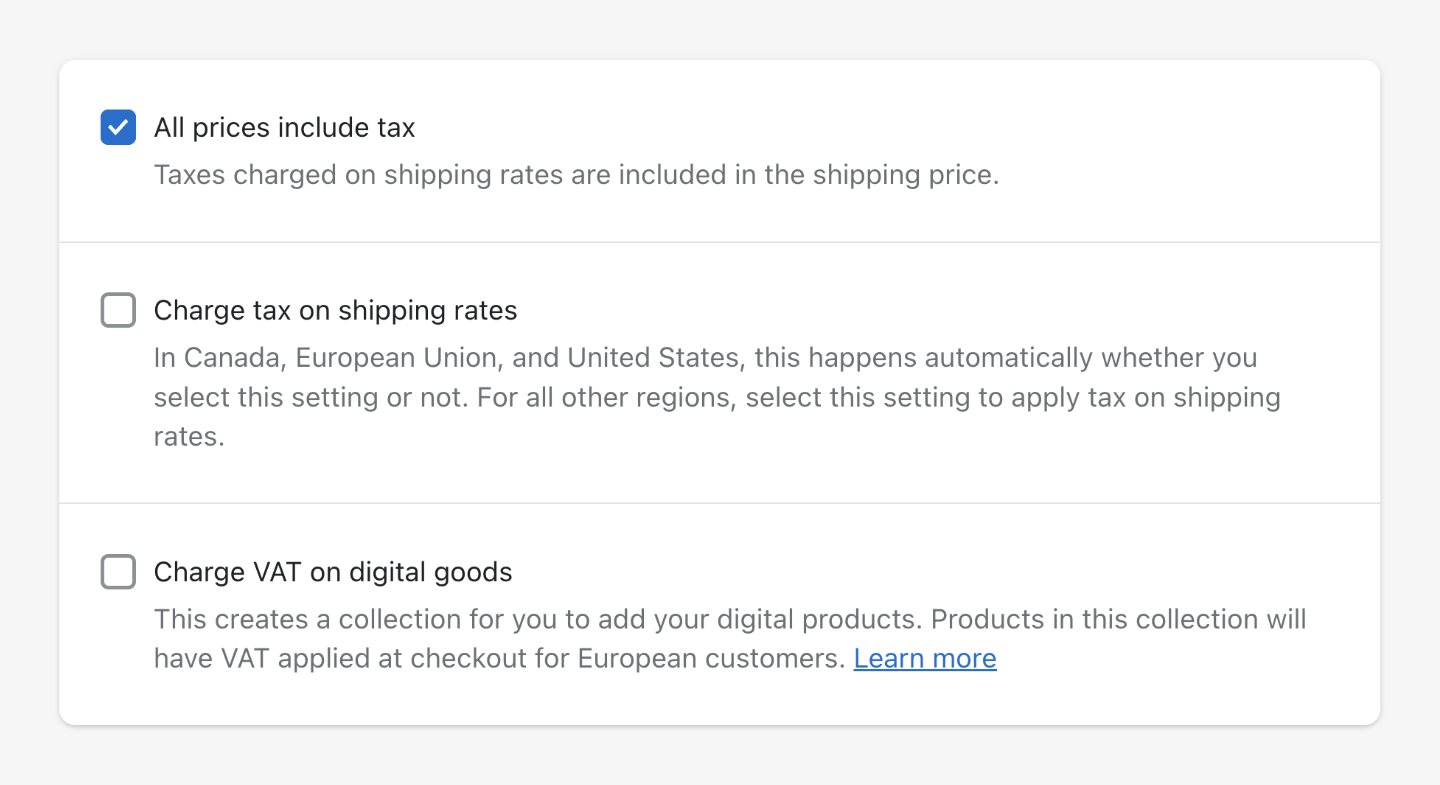

Select a state in which you are registered. Leave this box blank if you have applied. Setup your sales tax shipping options.

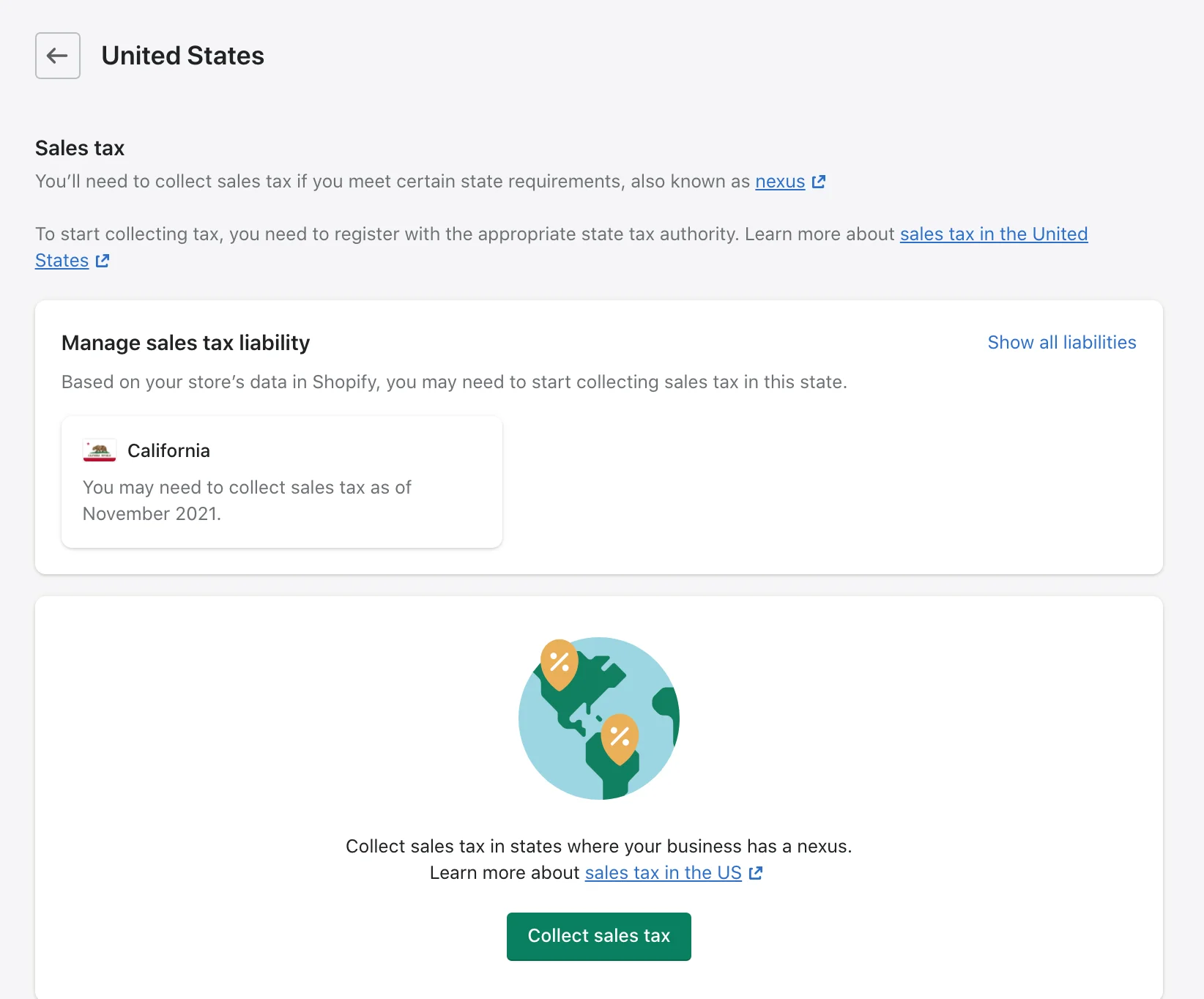

Shopify will issue a 1099 to store owners and the IRS when a store hits 200 transactions and 20K in sales. Were not able to provide any legal tax advice we always recommend consulting a local tax authority or tax professional. To the right of that click show all liabilities.

Log in to your Shopify account. Then those taxes will be reported and remitted to your government. Shopify provides tax reports however this ecommerce platform does not document or dispatch your tax report to the corresponding authorities.

You will see a section at the top of the screen that says manage sales tax liability. Next to the US click manage. Having the necessary documents readily available when meeting your Shopify tax accountant will save a lot of time.

To help with your sales tax reporting you can download a taxes finance report and a sales finance report to collate information on order amounts taxes POS billing and shipping locations. When account is created and verified you can go in to the Customers tab now go to the customer and select tax exempt. After that follow your Shopify Admin to Settings and Taxes.

That you have to do manually or get Shopify tax app to do just that like Taxify. Not qualifying for a 1099-K doesnt free you from paying taxes and Shopify still reports your income to the IRS so you must find the documentation for your earnings yourself. Get Your Bookkeeping up to Date.

If you qualify for a 1099-K the form will show up and you will be able to download it. You may have to enlist your business with your government or tax authority to deal with your business taxes. The Sales finance report can help with your sales tax reporting.

1099s are available to download in the payments section. Add information for sales tax exempt customers. To file your taxes you need to ensure your books are up-to-date.

If you have other income and file a tax return you report any. Go to the payments section. Specifically there is the tax filing report that allows you to check on the sales tax collection during a certain period.

This can then be used to complete your tax returns. Go to the Reports page. If you have no other income then you dont have to file a federal tax return if your yearly profits are under 40000 not 60000.

This is totally separate from income taxes. Uncheck the Calculate Taxes Automatically button. Shopify isnt going to help you with tax filing but you do have access to reports to make the process easier.

Ad Automate Shopify tax rules compliance with help from Avalara. Make sure you have an American store address in a US shipping zone for the manual one. Tax planning takes careful consideration and attention to detail.

However tax laws and regulations seem to be complex and often change through times. Click on Documents at the top left corner. A clear set of books gives an accurate view of your businesss income and expenses.

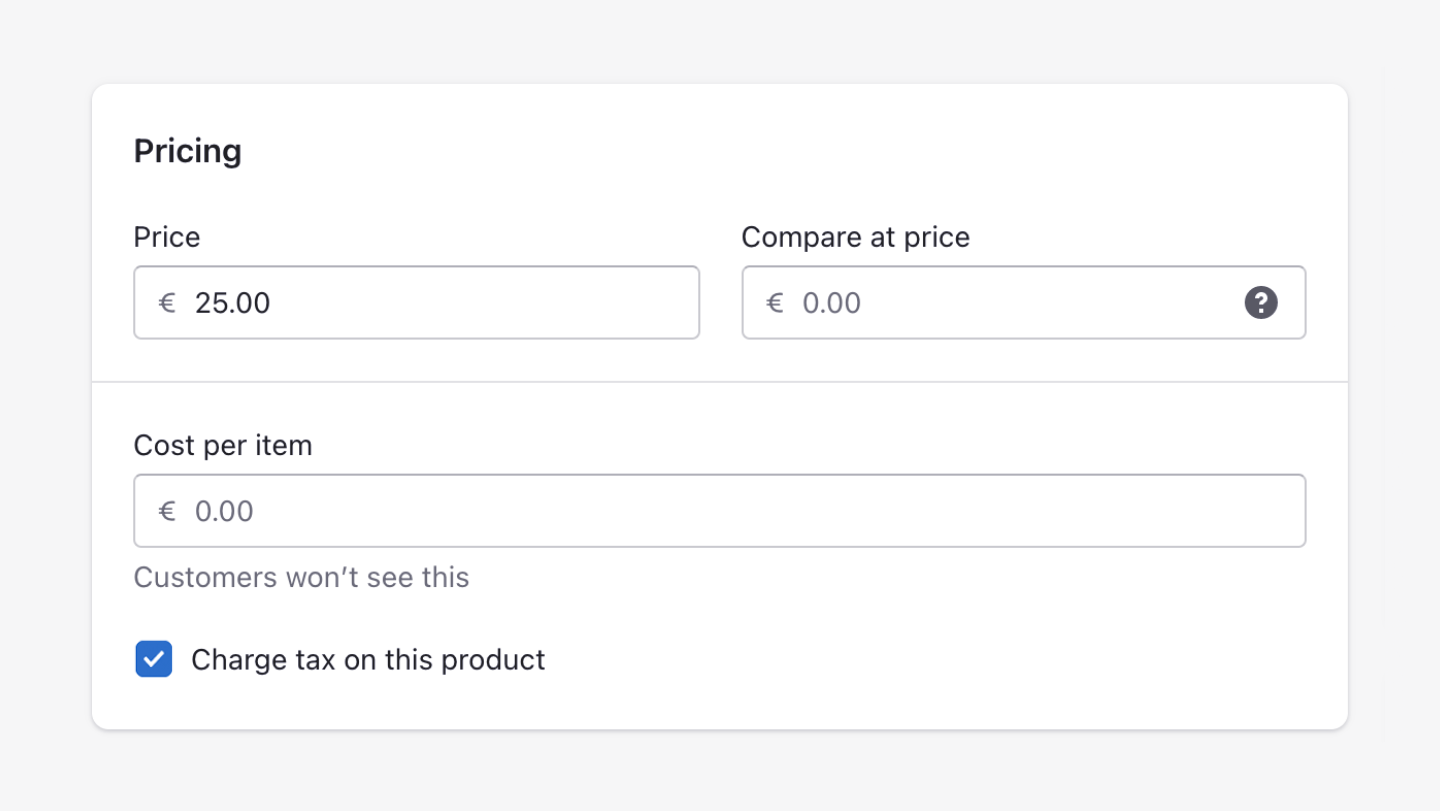

You can export this report as a CSV file that includes the order amounts taxes POS billing and. Then in the Tax. Tell Shopify which products should collect sales tax.

With a prebuilt integration and free trial getting started may be easier than you think. But here are the basic steps we suggest you go through. 1099s are available to download in the payments section.

From your Shopify admin go to Settings Taxes. This too can be done on your Shopify stores admin panel. To go more in detail Shopify works based on other default sales tax rates which are often updated.

After signing in to your Shopify admin page click on settings on the bottom left and click taxes. Theres a manual and automatic tax setting for the US. Happy to provide some guidance.

In the Tax regions section beside United States click Set up. Lets dive into each with screenshots and explanations. The Taxes finance report can provide a summary of the sales taxes that were applied to your sales.

I have done what youre saying for a couple stores in the past and they always got burned by people selecting the option to be tax exempt in. The more organized and prepared you are the better. While tax laws and regulations vary based on factors like location and what youre selling Shopify makes it easy for you to manage your taxes.

11-04-2021 0606 PM. With that said its worth noting that Shopify does not file or remit taxes for you. In the Sales tax collection section click Collect sales tax.

Integrate Taxify directly into your Shopify store to automate the entire tax process. Make sure to set up your sales tax rates before you even make your first sale. Once you have done this and you have been assigned a sales tax ID youll be ready to set up sales tax in Shopify.

Here are the steps to follow. Theres a Base Taxes section where you can pick the rates for each state the you sell to. Tell Shopify where to collect sales tax.

Shopify will issue a 1099 to store owners and the IRS when a store hits 200 transactions and 20K in sales.

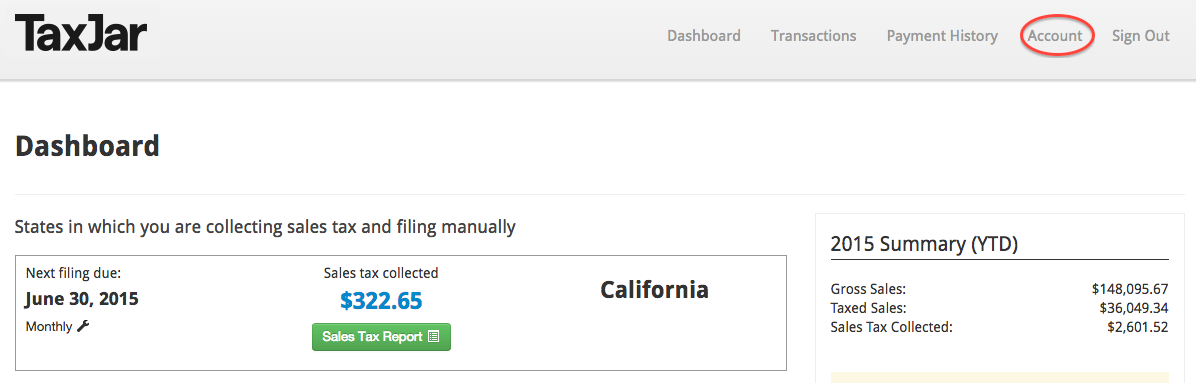

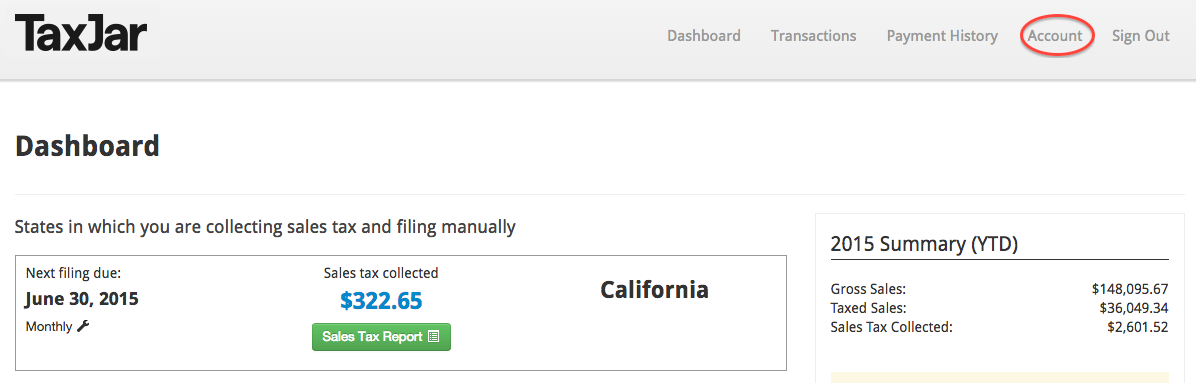

Sales Tax Guide For Shopify Sellers Taxjar Developers

Set Tax Rate For New Pos Location On Shopify A How To Guide Shopify Sms Credit Card Payment

Why Are Taxes Missing On My Shopify Orders And Invoices Sufio For Shopify

Shopify Sales Tax Report How To Find Understand It

How To Start A Shopify Store Infographic Shopify Tutorial Shopify Store Online Business Launch Shopify Business

How To Charge Shopify Sales Tax On Your Store May 2022

Shopify Sales Tax The Ultimate Guide For Merchants Updated 2020 Avada Commerce Sales Tax Tax Software Business Tax

Hire The Best Shopify Developer For Your Brand Development Shopify Hiring

Sales Tax Liability 5 Things To Know For Your Shopify Store Taxjar

Include Or Exclude Tax From Product Prices In Shopify Sufio For Shopify

Sales Tax Liability 5 Things To Know For Your Shopify Store Taxjar

Shopify Sales Tax Setup Where And How To Collect Ledgergurus

Shopify And International Taxes Eastside Co

How To Charge Shopify Sales Tax On Your Store May 2022

Sales Tax Guide For Shopify Sellers Taxjar Developers

Shopify Colorado Sales Tax Ecommerce Bookkeeping Services Business Structure

Set Customer Account Preferences On Shopify In 3 Easy Steps Shopify Background Images Customer

Shopify Sales Tax Setup Where And How To Collect Ledgergurus

Suronjoy Roy I Will Design Shopify Website Or Online Store With Shopify Theme For 25 On Fiverr Com In 2022 Shopify Website Design Shopify Website Shopify Theme